According to the Federal Reserve, the average American household carries $135,924 in debt. From credit cards to student loans, these numbers are staggering. But there is hope! This debt amount is DOWN from the previous year, which means that people are starting to get wiser about financial planning.

With momentum in the right direction, NOW is a great opportunity to get our children on board with saving and spending strategies that last a lifetime.

Not sure where to start? Many people turn to money-savvy entrepreneur Dave Ramsey to get out of debt; his Financial Peace University has already influenced more than 5 million people! Our family has put his strategy to work in our own home, and I have since adjusted the steps to help my kids better visualize the process.

Note: My way of adjusting the Baby Steps for my own kids has not been endorsed by Dave Ramsey or his entities.

THE FIRST STEP is to save $1,000 as an emergency fund.

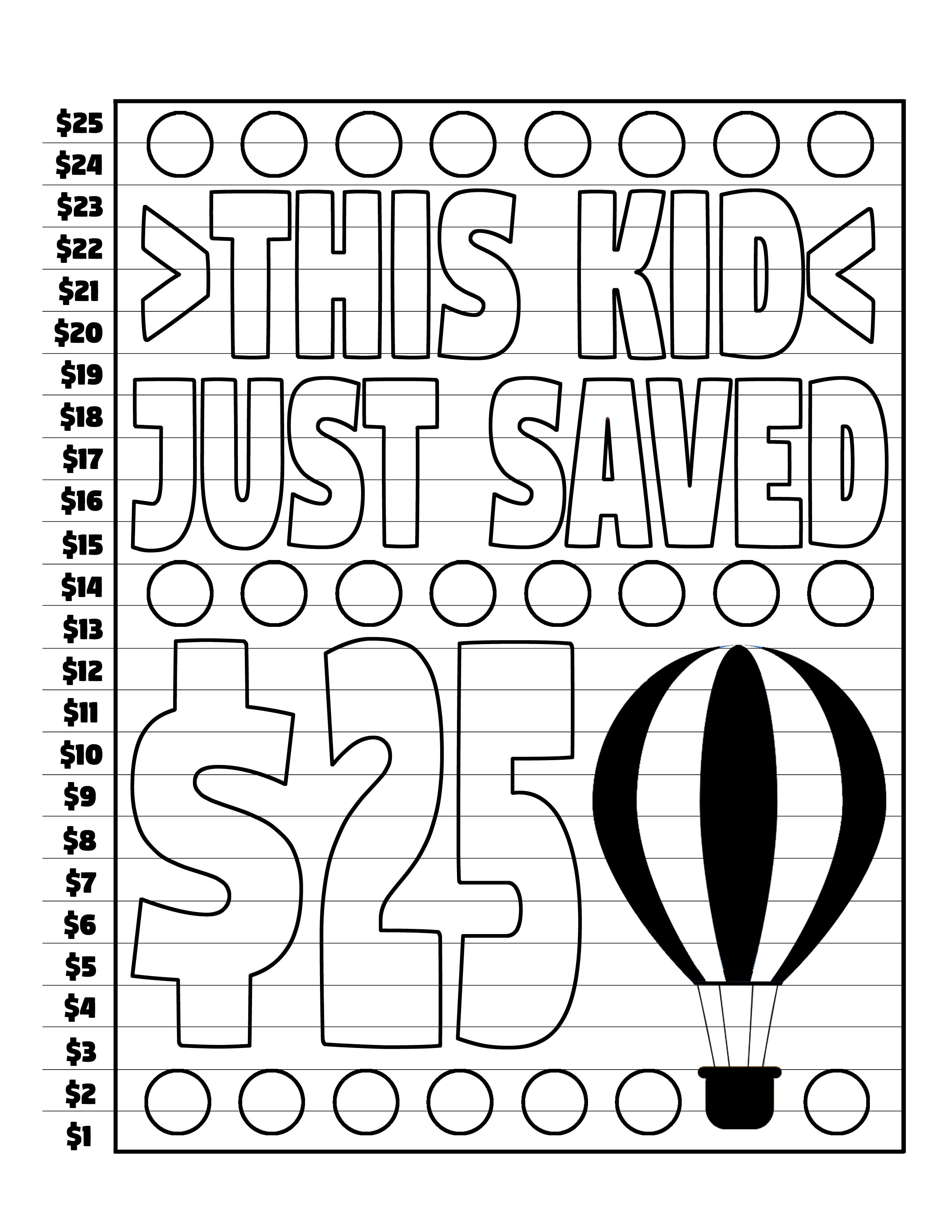

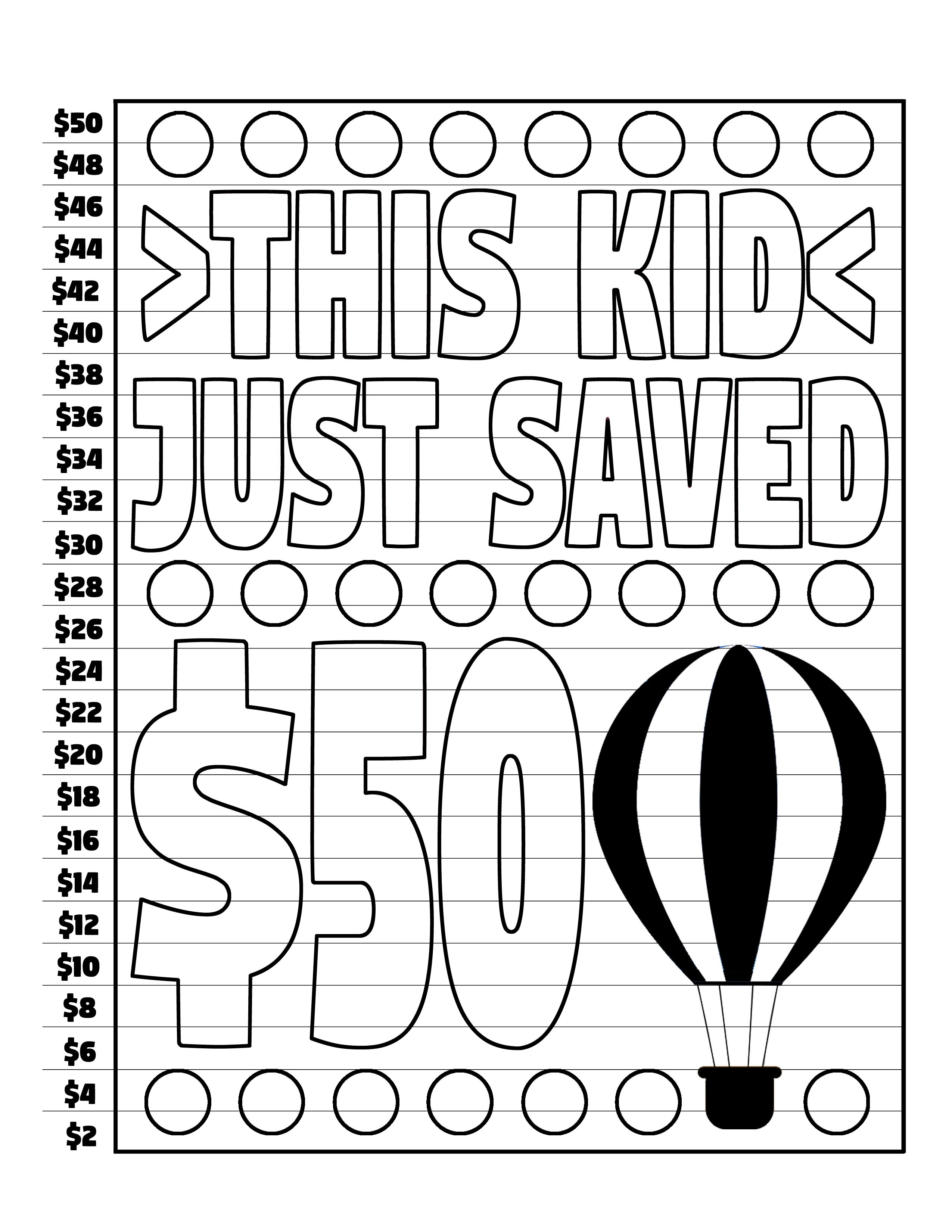

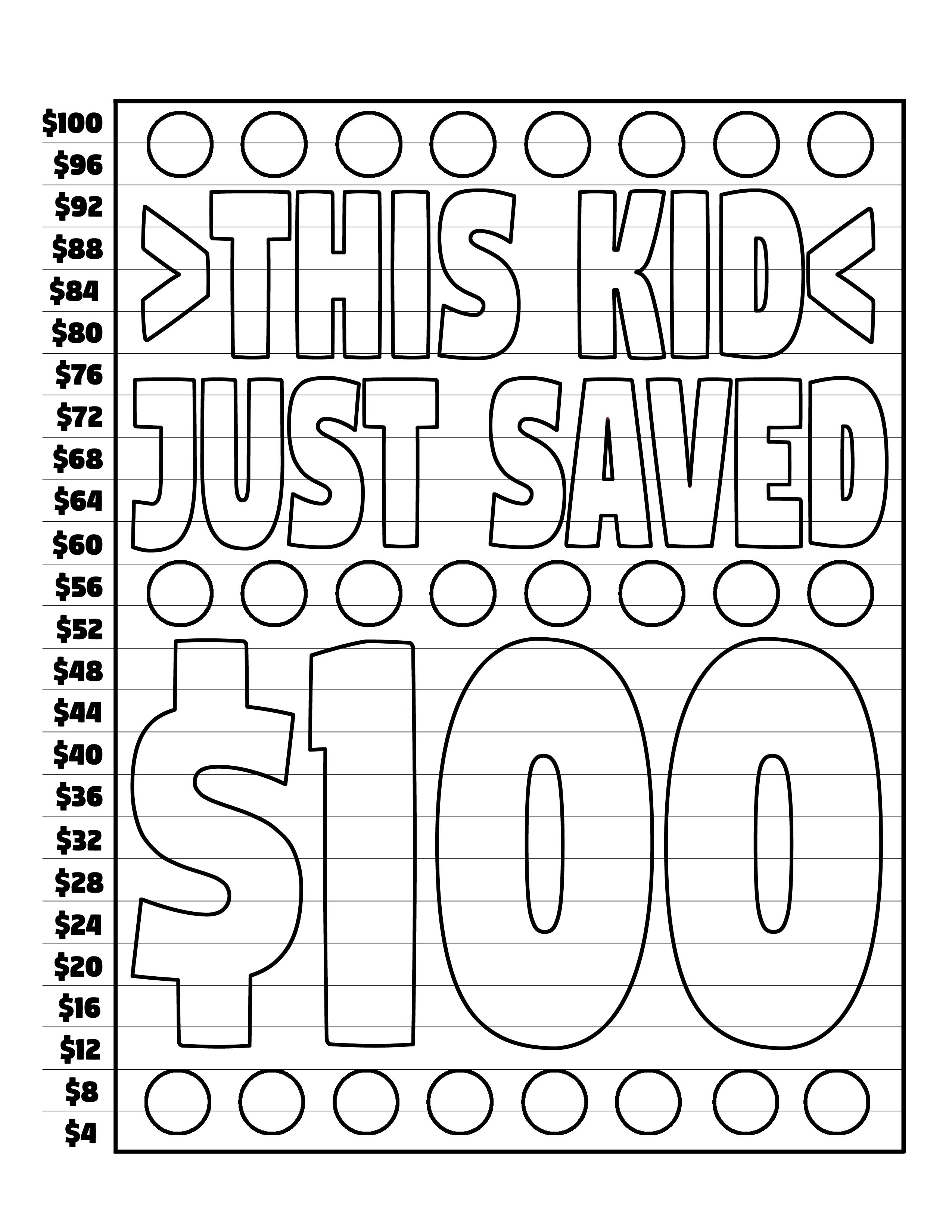

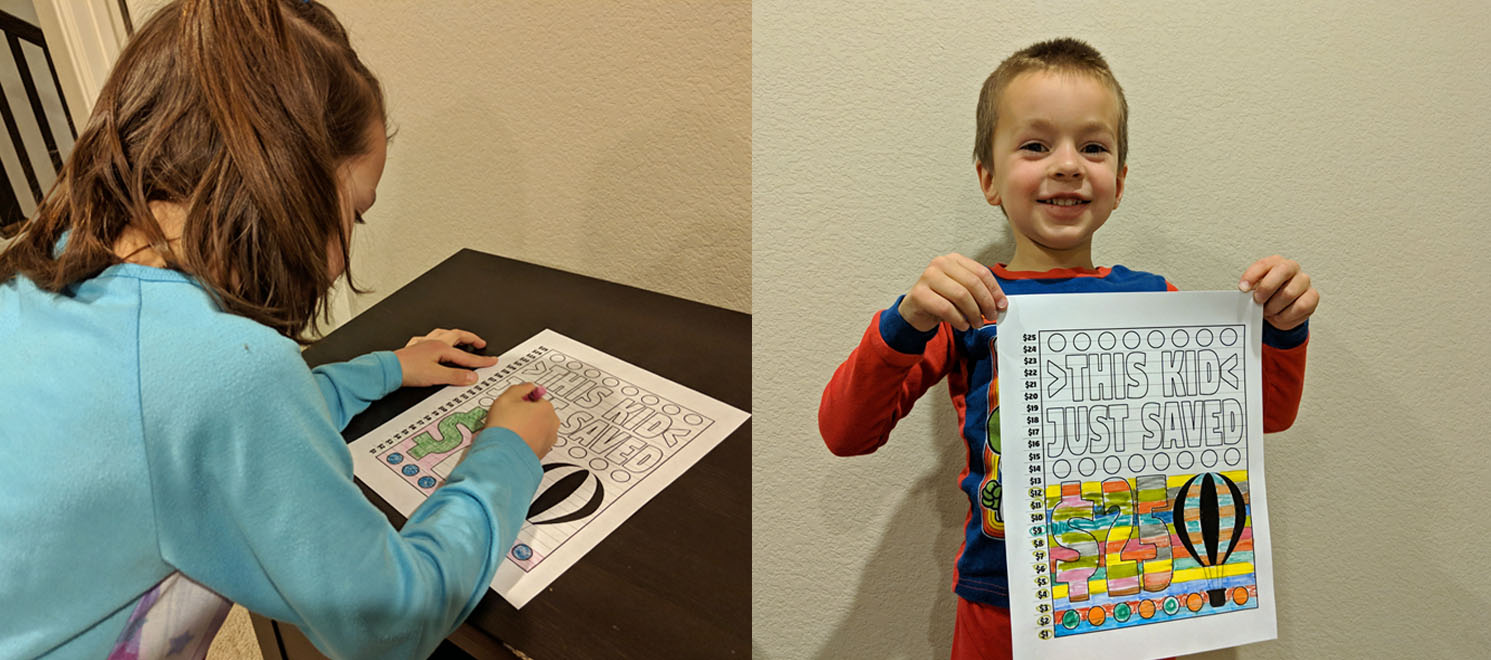

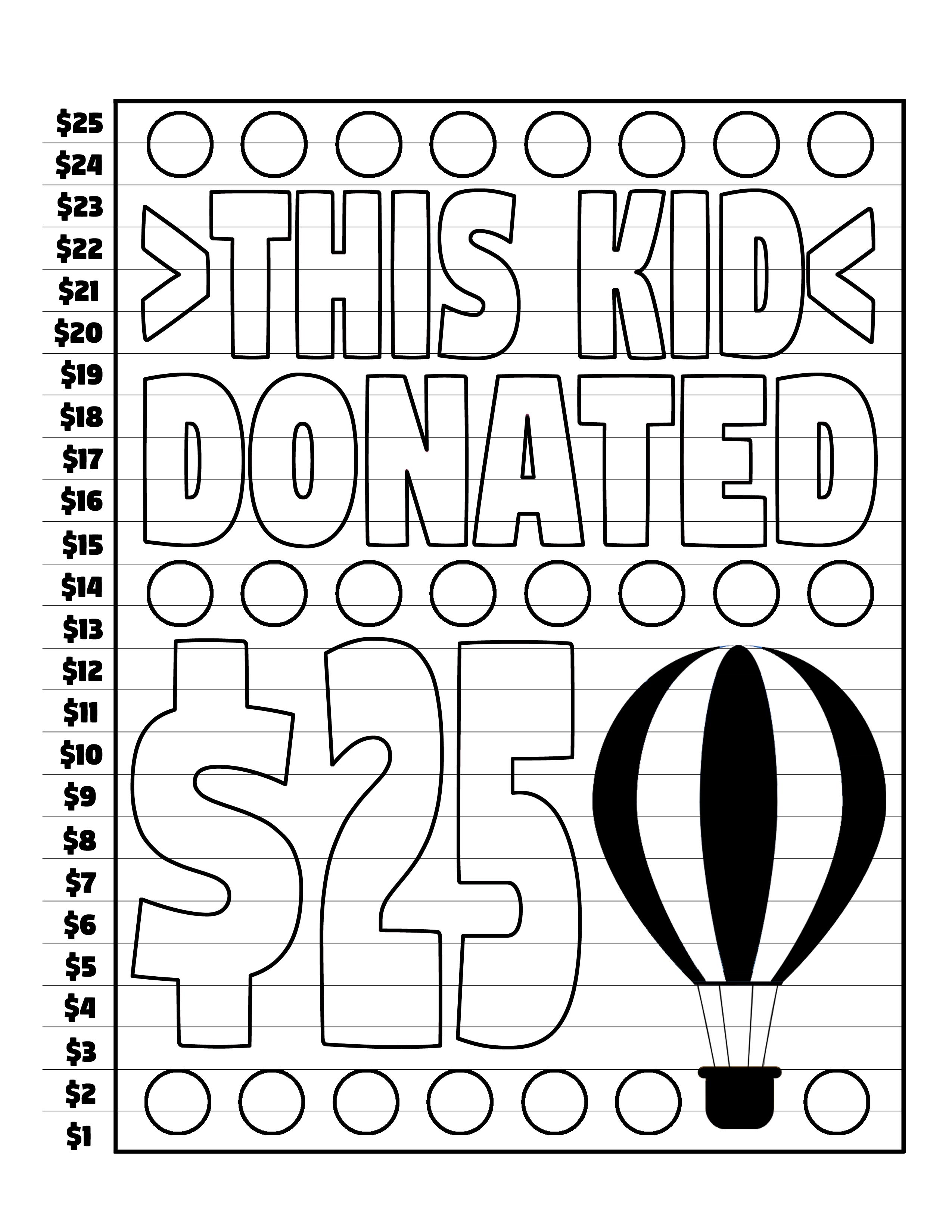

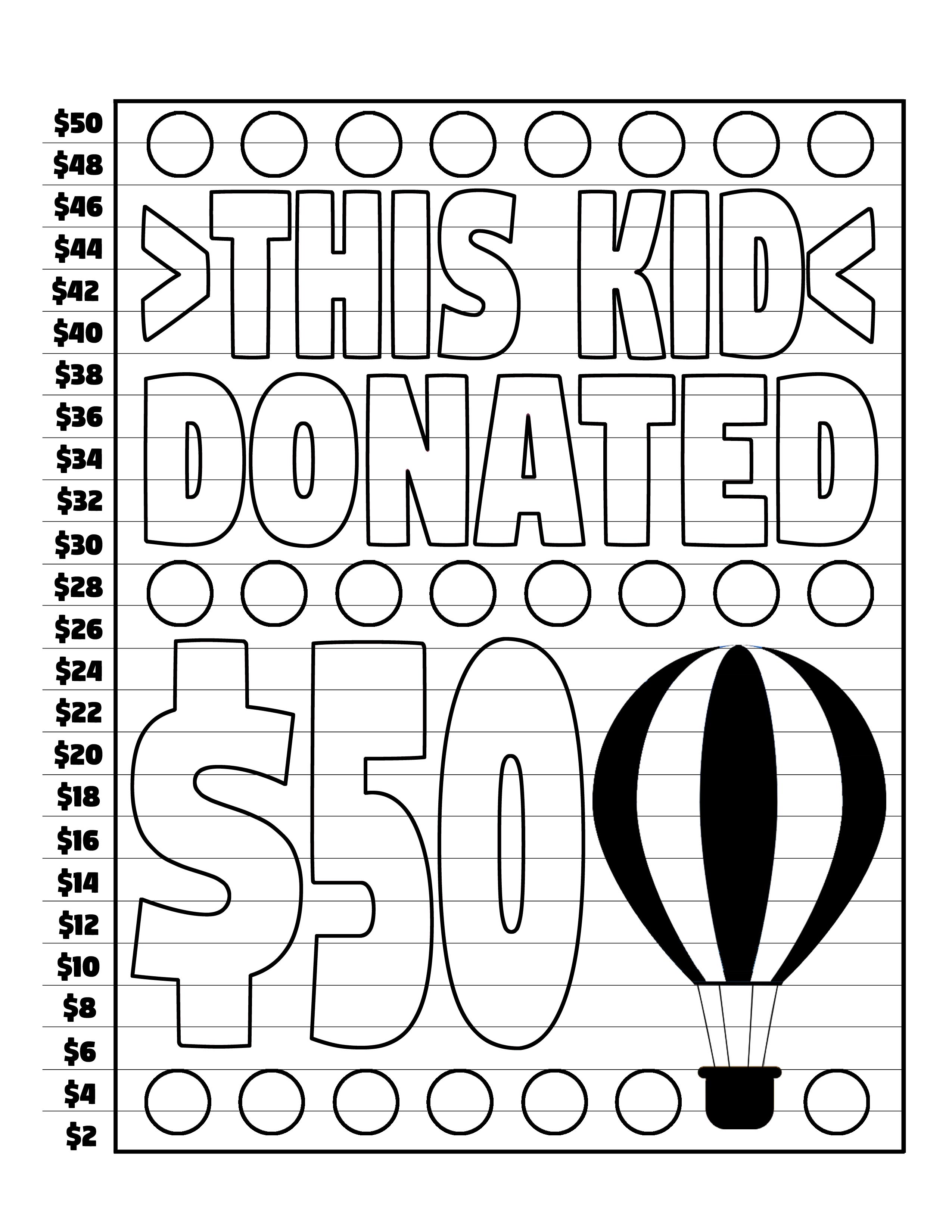

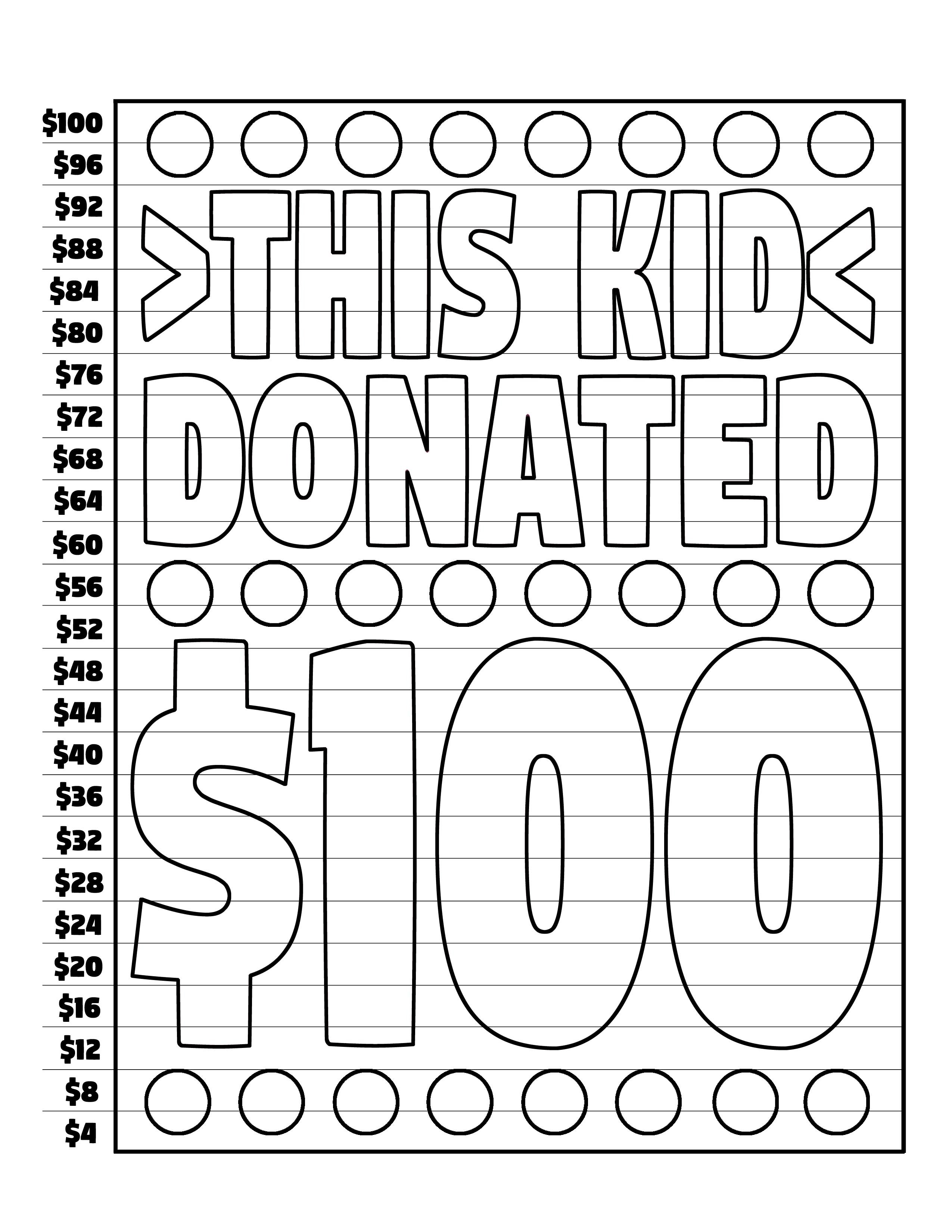

How can we translate this idea into something for our children? Think about what would constitute an emergency in your child's life. Losing a favorite blankie? Accidentally breaking a friend's toy? Decide on a value together and work from there. Your child's emergency fund will vary by family, but here's what works for us: For my 4-year-old, we decided that $25 was a good number to start the process, whereas $50 was more appropriate for our 6-year-old. Eventually, as your child ages, this number will reach the $1000 mark.

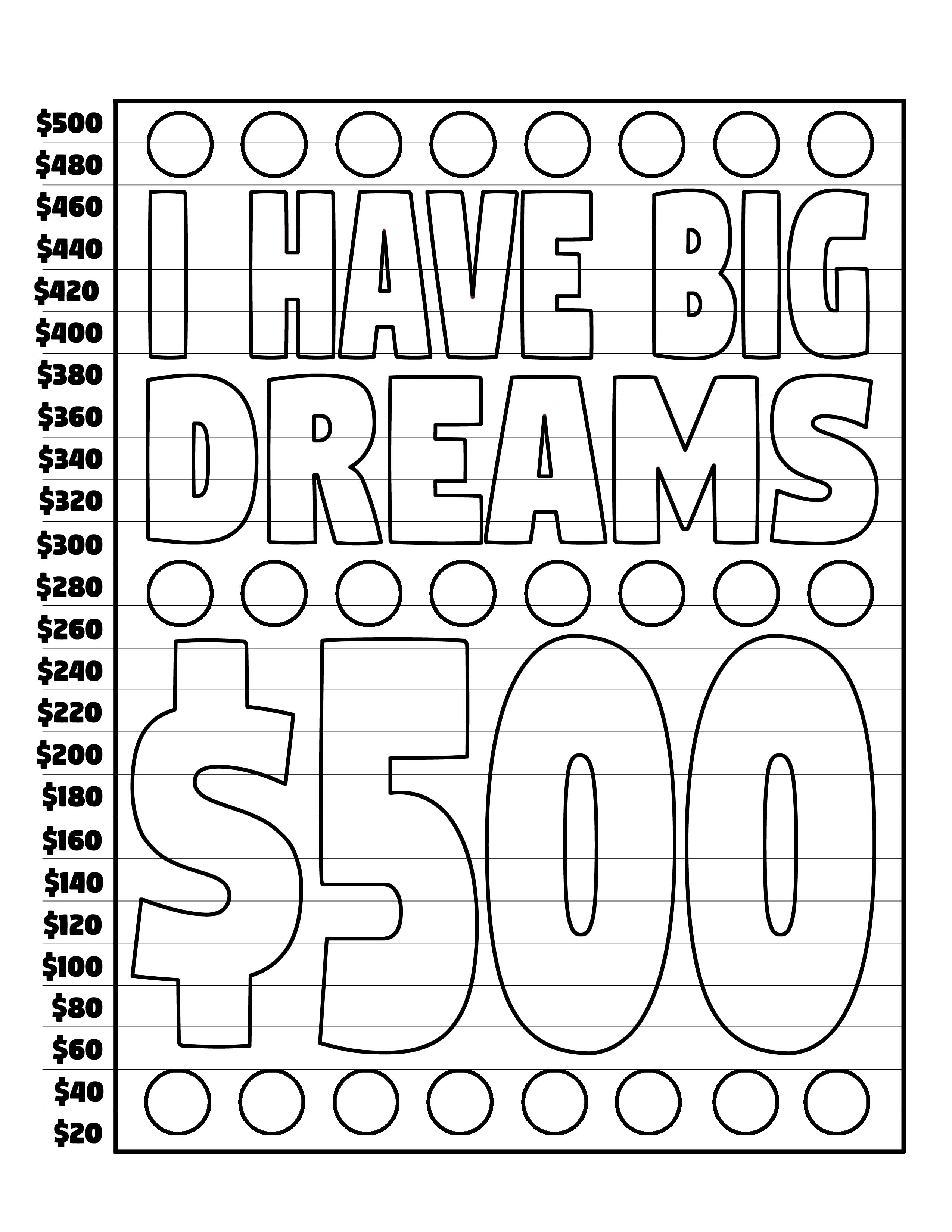

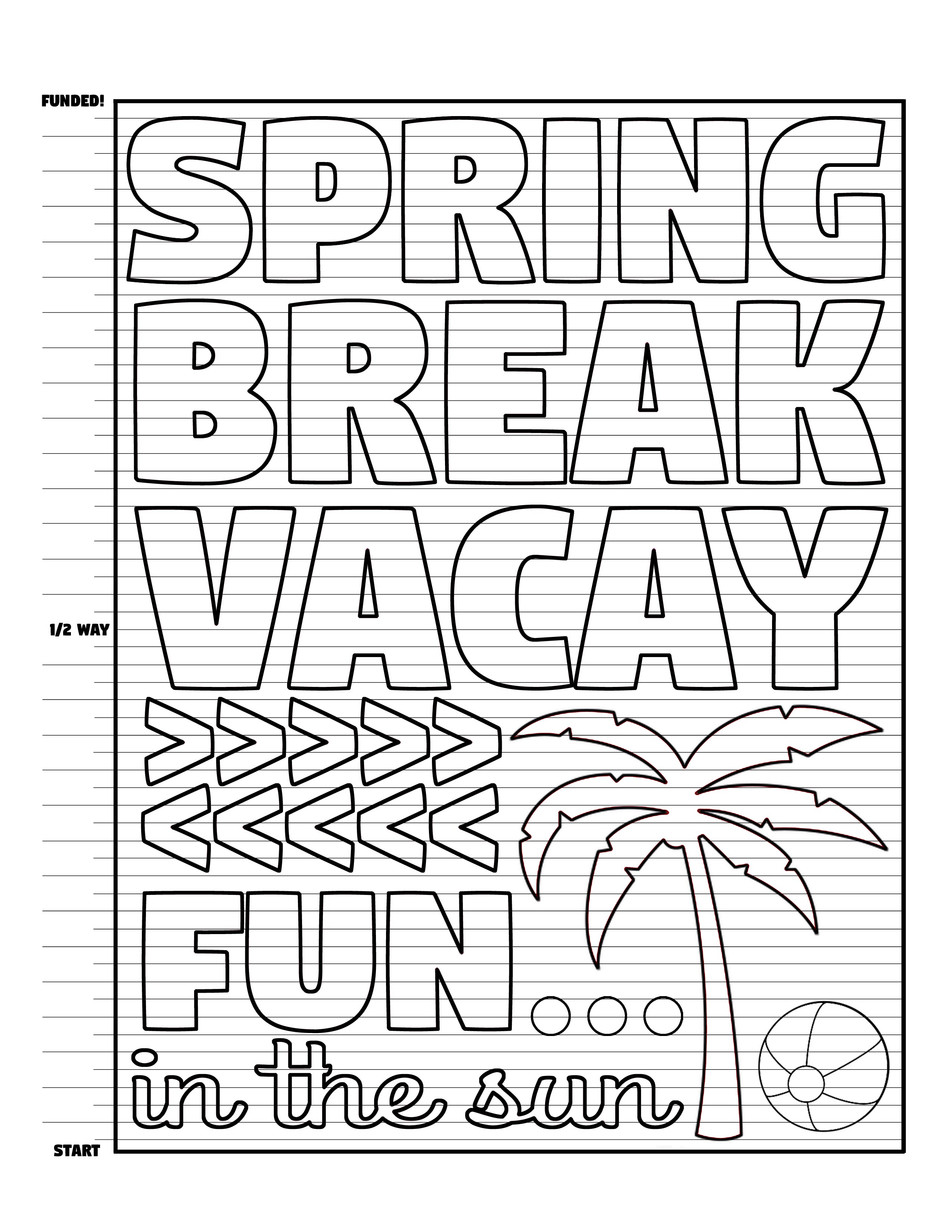

Right-click on an image below and select "Open image in new tab" to access your free downloadable chart:

|  |  |  |

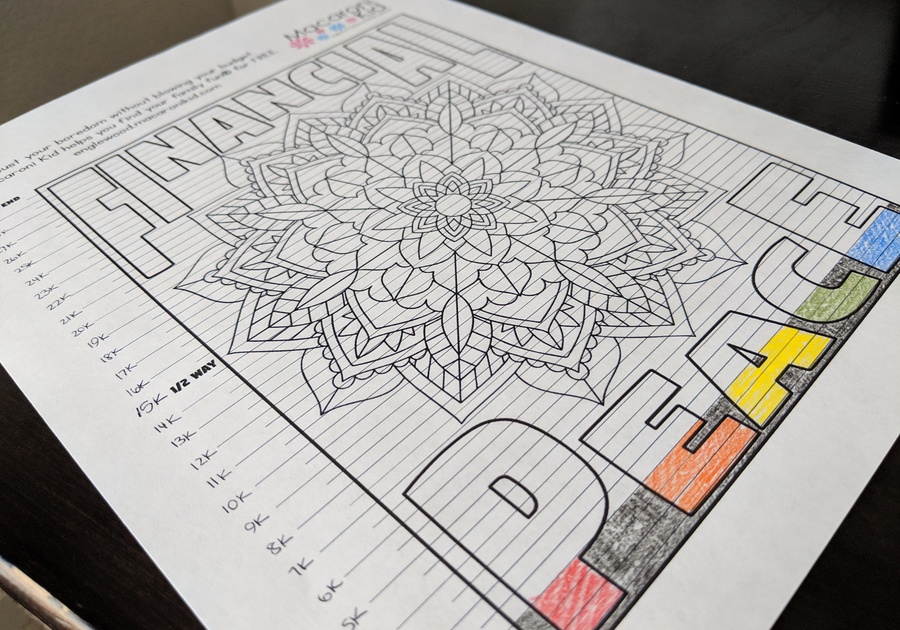

I drafted up a money-saving chart for my kids to visually see the progress they were making each time they added money to their piggy banks.

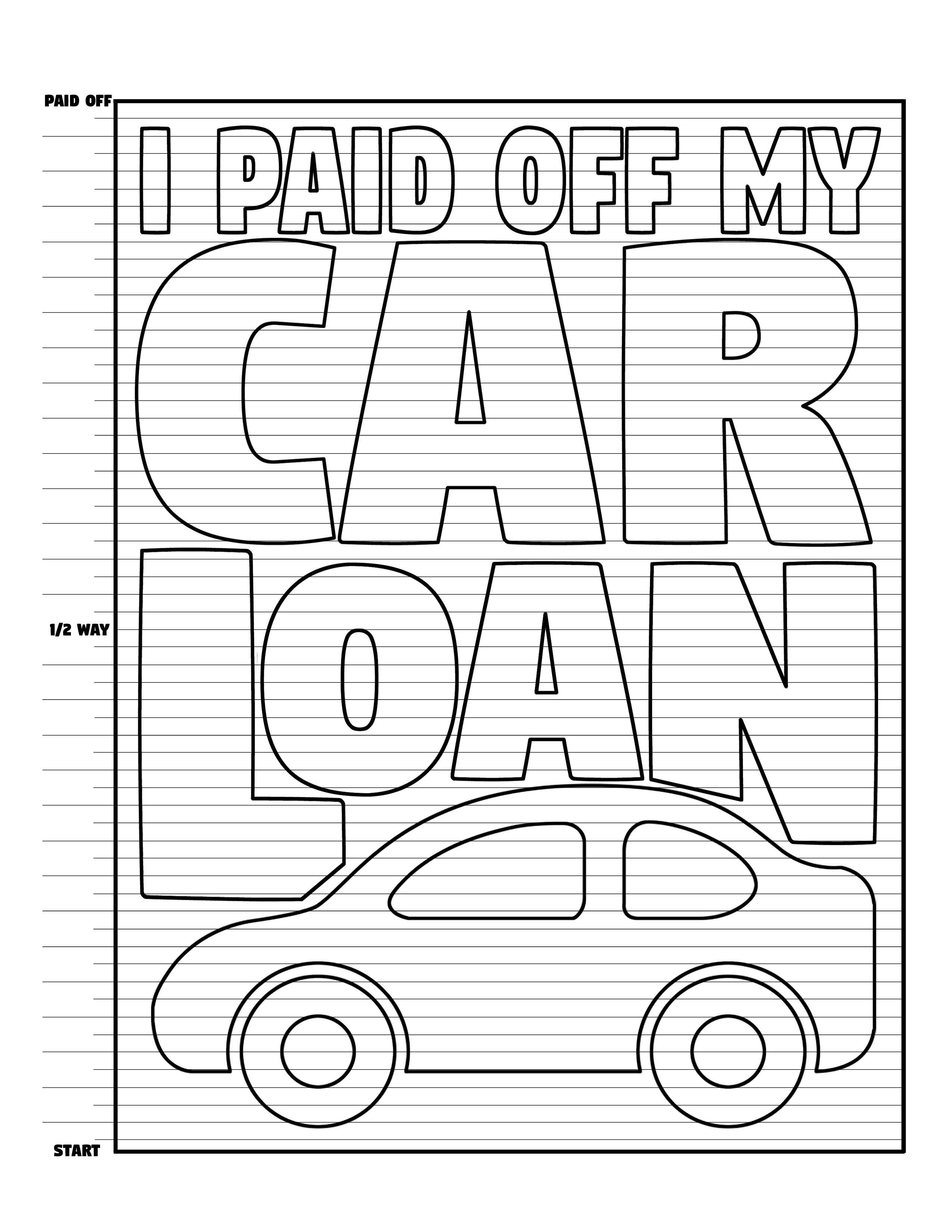

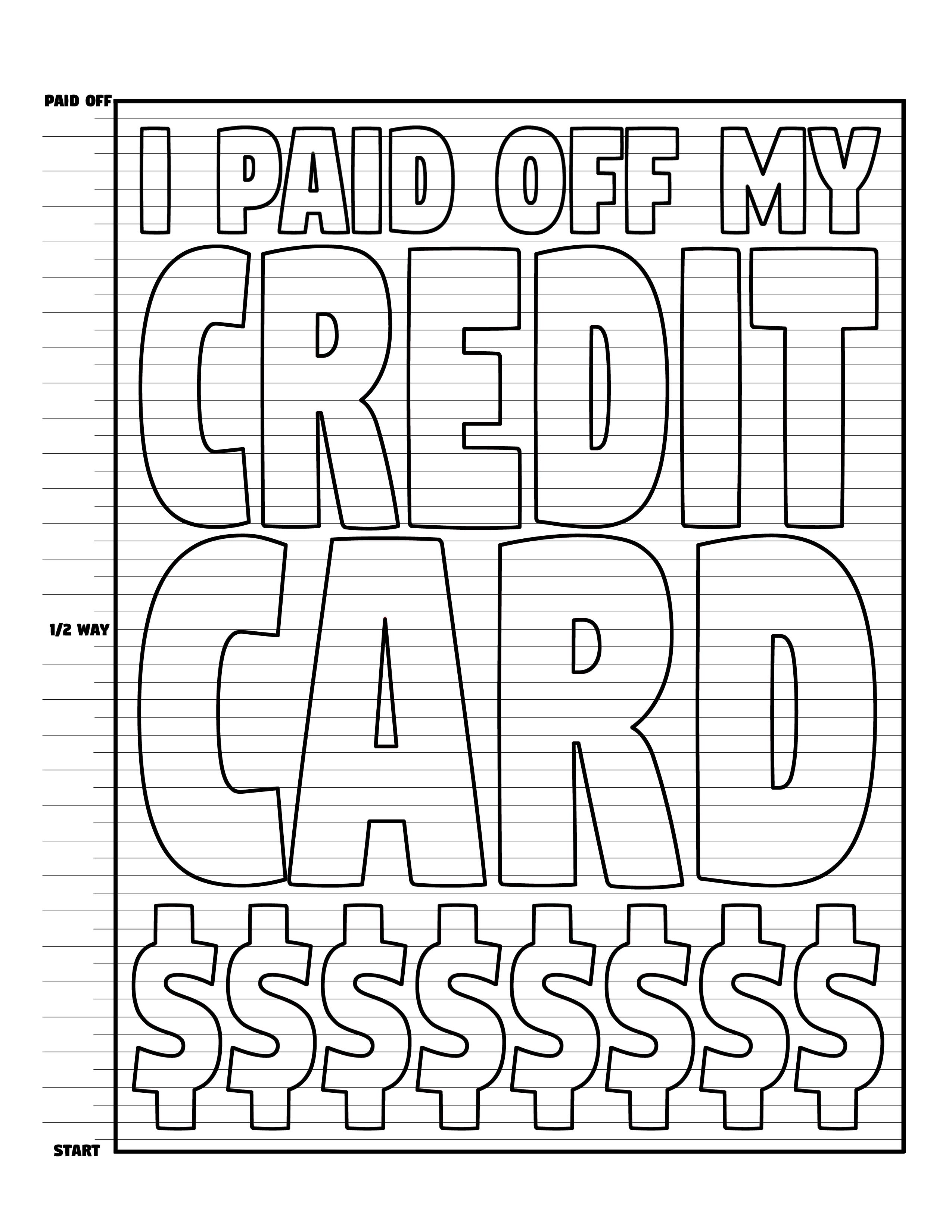

THE SECOND STEP is to pay off debt using the debt snowball. In an over-simplified nutshell, start by paying your smallest debt first, then work your way up.

How can we translate this idea into something for our children? There's a good chance your 4-year-old doesn't have any debt yet, but perhaps your teen owes grandma a little money from a personal loan. Regardless of the situation, paying off those debts is an important, teachable skill. Establishing a payment plan is the most critical part of paying back a debt. How much and how frequently will your child be making payments?

Want to visually see the money being paid back? We've got some FREE debt charts to get you on your way. Right-click on an image below and select "Open image in new tab" to access your free downloadable chart:

|  |  |  |

THE THIRD STEP is to save 3-6 months of expenses for emergencies.

How can we translate this idea into something for our children? Reflect upon the number you choose for step 1. Would it make sense to multiply that by 1 per month? Or 10 per month? For my 4-year-old, a $250 fully-funded emergency fund is great, but for a teenager, that number could be $1000+. Be sure to print your free money-saving charts to help your child visualize his/her progress toward the BIG GOAL.

THE FOURTH STEP(to be done alongside steps 5 & 6) is to plan for the future by investing in retirement.

How can we translate this idea into something for our children? Saving for the future can be for ANYONE. The main goal of this step is to invest 15% of your income into pre-tax retirement. My kids don't have employers with 401(k) plans, but this step is a great reminder to think about and save for the future - car payment, down payment on a home, etc. Talk to a financial advisor about different savings accounts or savings bonds.

THE FIFTH STEP (to be done alongside steps 4 & 6) is to save for your child's college fund.

How can we translate this idea into something for our children? Teach them to save for their own college expenses. And guess what... we have a chart for that! Plus, we've created some additional savings charts for those "big ticket" purchases.

|  |  |

THE SIXTH STEP (to be done alongside steps 4 & 5) is to pay off your home.

How can we translate this idea into something for our children? Most kids don't own their own property, but homeownership is still an important thing to understand. Browse local home buying/selling sites together to help your children understand the upfront costs of homeownership. Use this time to learn basic repair skills (laundry machine, drywall patch, landscaping, etc) to help avoid costly repairs in the future.

THE SEVENTH STEP includes building your wealth and giving.

How can we translate this idea into something for our children? Work as a family to get to this step. Lead by example! You can download your own debt-free charts and money-saving printables. Color them together to illustrate the progress you've made.

Right-click on an image below and select "Open image in new tab" to access your free downloadable chart:

|  |  |

|  |  |

GET YOUR FREE PRINTABLES BY CLICKING ON THE IMAGES ABOVE

How to use your printables:

1) Download and print your files.

2) Customize your design by writing in $$ amounts at the markers on the left side of the image.

3) Each time you reach a milestone, color in the design up until that marker.

4) Reach the top and CELEBRATE!

5) Cut out your design and display it as a reminder of how far you've come.

Disclaimer: This article was written by a Dave Ramsey super-fan. These printables and ideas for teaching your children have not been endorsed by Dave Ramsey himself. They are merely suggestions based on his thoughtful strategies.